Telematics

What is telematics?

Telematics is a technology that gathers data about a driver’s behaviour, such as their speed and how quickly they brake. Insurers can then use the information to determine how well the vehicle has been driven.

Driving data can be combined with traditional data points, such as age, gender, and vehicle type, to build a more accurate picture of a policyholder’s risk profile. Furthermore, insurers can use telematics to encourage safer driving behaviour, reducing their risk and achieving lower premiums for policyholders.

How does telematics technology work?

Telematics uses a combination of sensors, Global Positioning System (GPS) software, and on-board diagnostic vehicle data to measure a policyholder’s driving.

- Sensors detect the forces a vehicle is under. They are used to measure a driver’s behaviour, including their braking, acceleration, and corner handling.

- GPS tracks where the vehicle is and how fast it is travelling. It can also provide information such as weather conditions and traffic.

- On-board diagnostic data is pulled directly from a vehicle’s diagnostic system. This provides information such as engine health and fuel efficiency.

The data is sent wirelessly to the insurer in real-time where it can be analysed to see whether the vehicle is being handled safely for the situation, taking into consideration factors such as speed limit, traffic, and weather conditions.

What data can telematics provide?

Insurers can choose to monitor a wide range of factors, including:

- Speed

- Braking

- Acceleration

- Cornering style

- Distance travelled

- Distracted driving

- Crash occurrences

- Time of day

- Weather conditions

- Steering control.

What are the different types of telematics devices?

There are different types of telematics devices that can be used to gather driving data. Telematics insurance can work using any of them. But some may be more appropriate than others, depending on your business and policyholders. Here are some of the most commonly used devices.

Black box

One of the most common telematics devices is the black box – a small device that is fitted to the inside of a car.

The black box is so ubiquitous that telematics insurance is often known as ‘black box insurance’, even when other devices are used.

Black boxes are typically installed by a professional from the insurance company. Once installed, they provide data whenever a driver makes a journey in the car.

Black box are reliable and cannot be tampered with by policyholders.

Self-installed devices

Self-installed devices are fitted to the car by the policyholder, removing the cost and time required to installl a black box. Devices are usually inserted into the car's on-board diagnostic socket or the 12-volt socket.

Smartphone app and Bluetooth devices

Smartphone apps use the phone’s in-built sensors to detect driving data. The data is transmitted by the smartphone app. They are usually paired with a low-cost Bluetooth beacon that is fixed to the vehicle for increased data capture.

An additional benefit of using a smartphones as a sensor app is the ability to detect distracted driving caused by mobile phone use. It is well documented that distracted driving is one of main causes of vehicle accidents.

How does telematics insurance work?

A telematics insurance policy is a type of usage-based insurance (UBI).

There are two main types of UBI:

- Pay-As-You-Drive (PAYD) – tracks the number of miles a policyholder drives

- Pay-How-You-Drive (PHYD) – monitors a policyholder’s driving behaviour.

The premiums for a Pay-As-You-Drive policy are based on how far a policyholder drives while the premiums for a Pay-How-You-Drive policy are determined by how safe a driver they are. This gives insurers the opportunity to modify the behaviour of their policyholders to make them safer drivers.

The policyholder agrees to have their driving monitored by a telematics device. This data is sent to the insurer and builds up a picture of how they drive.

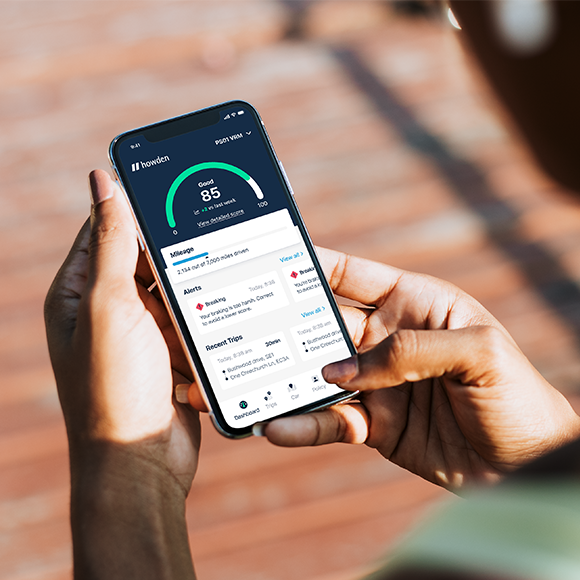

Policyholders will receive a driver score that reflects how safely they drive. The score will go down each time they drive poorly and up when they drive well. This score is visible to the insurer as well as the policyholder through the insurer’s app or website.

If the policyholder drives safely, insurers can offer a premiums discount when they come to renew.

Telematics also allows insurers to positively influence a client’s behaviour through a combination of coaching and incentives throughout the duration of the policy.

Coaching

Identifying the flaws in a client’s driving allows insurers to provide personalised feedback to make them safer drivers.

Coaching mechanisms are developed using psychological practices. Clients receive the right information at the right time to help them understand the risks of their behaviour and, crucially, how they can drive more safely.

A driver will receive coaching whenever there is a flashpoint in their driving. This could be a single serious issue like speeding or repeated instances of poor driving behaviour, such as going too fast around corners.

Incentives

Coaching is essential to give clients the knowledge they need to become safer drivers. But presenting it in an engaging way is how insurers can most effectively motivate their clients to take the necessary actions to become safer drivers.

Insurers can do this by offering their clients incentives. People are naturally driven by rewards and a sense of achievement. Telematics allows insurers to harness this impulse towards the goal of safer driving. This is known as ‘gamification’.

On its most basic level, clients will engage with the platform to check their driving score and to learn how they can improve it. This can be addictive in itself and gives clients a reason to keep returning to the platform.

Gamification can be introduced in a variety of more innovative ways. Giving clients the opportunity to earn badges and certificates for achieving certain milestones can help to create a sense of progression along the path towards safer driving. Publishing performance statistics and achievements on a leader board can help to foster competition, motivating people to drive more safely.

Innovative insurers could even offer rewards that are linked to positive driving behaviours, such as free food and entertainments, and explain how to achieve them. This gives drivers something to work towards as they become safer drivers.

Ultimately, the application of gamification and rewards is a large part of what makes telematics effective at improving driver safety.

Drivers who regularly check their driving score are more likely to become safer drivers as it alerts them to issues that need addressing.

Giving clients a reason to open the app with the prospect of rewards and competition therefore creates a virtuous circle where they’ll be motivated to check their score more often, resulting in them developing safer habits.

Who is telematics insurance for?

Telematics insurance has traditionally been aimed at new and young drivers, who typically pay more for their insurance. Other high risk groups, such as elderly drivers and convicted drivers, can equally benefit from a telematics policy.

However, there is an opportunity to market usage-based policies to experienced drivers.

Research shows that most people are happy to share data with businesses if there is a clear benefit for doing so. This means that many people could be open to having their driving monitored in return for lower premiums or value-added services such as rewards.

Another opportunity comes from catering to those drivers who want more personalised insurance. For example, infrequent drivers could get better value from a telematics policy.

Additionally, telematics has many commercial uses, including:

- Cargo transportation (including heavy goods vehicles and marine)

- Construction / heavy machinery

- Passenger transport

- Fleet management and optimisation.

Fleet managers can use the incentives and monitoring technology of telematics to reduce costs in a variety of ways, such as:

- Reducing fuel spend by improving driver habits such as smooth braking and acceleration, and turning the engine off when idle

- Improving driver safety by incentivising drivers to drive carefully

- Lowering maintenance costs by monitoring engine diagnostics for issues before they require expensive repairs

- Optimising vehicle usage by using telematics data to plan and monitor efficient usage

What are the benefits of telematics insurance?

Telematics insurance has many benefits for insurers and their clients, from influencing safer driver behaviour to an improved customer experience.

Influence driver behaviour

Telematics insurance allows insurers to influence the behaviour of their policyholders to make them safer drivers.

When a client has a telematics device in their car, it’s as though their insurer is in the car with them.

For many people, simply knowing that their driving is being monitored is enough to make them drive better. This is particularly true of those who are essentially good drivers but have developed bad habits.

At the same time, there are other people who want to drive as safely as possible but may not know how.

With telematics, insurers have the opportunity to positively influence their behaviour through real-time coaching.

This gives insurers the power to proactively reduce the risk posed by their clients, rather than simply respond to it.

If implemented correctly, a usage-based policy will make clients safer drivers. Research shows that the presence of telematics can reduce the number of people who drive above the speed limit by up to 70%.

Improved loss ratios

Telematics insurance rewards and encourages safer driving. This makes clients less of a risk, resulting in fewer claims and improved loss ratios.

The early adopters of usage-based insurance are naturally low-risk drivers. They regard themselves as safe drivers and are comfortable with their behaviour being tracked. As a group, they are highly profitable as they are less likely to make a claim.

A wider group of drivers may be open to having their driving monitored in return for lower premiums.

Telematics gives insurers the opportunity to make them safer drivers by positively reinforcing safe behaviour while addressing poor behaviours.

It’s in their self-interest to become a safer driver, as they will be able to get cheaper premiums, as well as rewards. In turn, this makes them more profitable clients as they become lower risk drivers.

More accurate pricing

A usage-based insurance policy allows insurers to make more accurate decisions when quoting clients. This helps insurers to protect against risks that go unseen under a traditional policy, while making it possible to provide competitive cover for higher risk groups.

The traditional data points that are used to calculate premiums – a client’s age, gender, credit score – are not necessarily indicative of driving behaviour.

There are many poor drivers who manage to avoid having an accident despite being unsafe. If these drivers don’t make any claims, they will be regarded as low risk. But nobody’s luck lasts forever – they could be just one mistake away from an expensive accident.

Telematics removes the mystery from the equation.

Poor drivers can’t ride their luck when their behaviour is being measured by telematics. This gives insurers the opportunity to raise their premiums in line with their true risk, or even cancel their policy if their driving is bad enough.

By the same token, traditional policies treat some drivers as high risk when, in reality, they are perfectly safe.

For example, new drivers pay much more for their insurance than experienced drivers as they are more likely to have an accident. But many new drivers are safe, meaning insurers are potentially missing out on covering profitable clients.

A usage-based policy allows riskier clients to prove themselves while putting the insurer in control.

In most cases, drivers will become safer drivers by interacting with the coaching in the app. Where drivers display risky behaviour, their premiums can be raised accordingly or even have their cover terminated.

Increased engagement and customer loyalty

Telematics can improve client relationships and increase customer loyalty, helping insurers to retain valuable customers.

Most drivers feel no loyalty towards their insurer and will simply switch to another supplier for a cheaper deal when the policy comes to an end.

This creates a race to the bottom between insurers with each trying to offer lower premiums to attract new clients.

Usage-based insurance policies can help insurers to retain clients by providing an addictive and rewarding experience. This will make insurers stand out from companies which only provide traditional polices.

By making driving feel more like a game, clients will come to regard it as positive in their life, rather than an begrudged necessity.

The sense of progressing through levels is addictive in the same way as a video game, while the prospect of rewards means that they feel the benefits of the policy in their daily life.

A usage-based policy gives clients the satisfaction of being recognised and rewarded for their efforts.

In turn, they will see that they receive lower premiums as a result of their safe behaviour.

Telematics allows insurers to be an engaging and responsive force in their clients’ lives, rather than a remote entity that only interacts with them when it’s time to renew. Consequently, clients will actually want to regularly check their driving score in order to level-up and earn rewards.

The more clients engage with their insurer’s platform, the safer their driving will become, resulting in them enjoying lower premiums. This, combined with the positive experiences built up over the course of the policy, will make a client more likely to renew with their existing provider rather than move to a competitor.

Improved claims handling and reduced leakage

Telematics reduces claims leakage by making claims management more efficient and preventing fraud.

Poor claims handling results in insurers paying far more than necessary to process claims.

Research by the audit specialist CWMC found that 41% of motor claims had leakage, averaging in a loss of £1,450.

Telematics helps to reduce leakage by giving insurers more control over the end-to-end costs of a claim, such as vehicle recovery and repairs.

Telematics can identify a crash in real time and send the insurer the First Notification of Loss (FNOL). This is used to initiate the claims process and provides benefits for both the insurer and the policyholder.

When a client is involved in an accident, the insurer will be notified straight away.

From there, they could arrange for the car to be towed to a contracted garage where the quality of the work and the cost of labour can be controlled. This will reduce the cost of the claim and make a costly consumer dispute less likely.

Similarly, the insurer could provide a replacement car at a rate that they can control, reducing the cost of the claim.

This also benefits a policyholder when they’re involved in an accident.

Once the insurer receives the FNOL, they can contact emergency services if the policyholder is unable to do so themselves, providing clients with an extra layer of security. Furthermore, the additional stresses of organising a vehicle replacement and repairs are removed by the insurer arranging it on their client’s behalf.

Telematics also makes it easier to assess claims, preventing leakage caused by labour-intensive investigations and missed instances of fraud.

Without the presence of telematics technology, the claims process relies heavily on the testimony of the policyholder to assess the validity of a claim.

This has two problems.

Firstly, the stress of being involved in an accident means that the memories of the client are often distorted and unreliable. The process of questioning is time-consuming and stressful for the client, while providing incomplete data for insurers to make a decision.

Secondly, some drivers exaggerate their claims to make their injuries seem worse than they really are, resulting in unnecessary pay-outs.

The presence of telematics in the vehicle reduces the insurer’s reliance on driver testimony.

Crash data helps insurers to reconstruct what happened. From the data, the insurer can determine important factors like how fast the car was travelling and whether the driver was braking before the impact.

This helps insurers to more accurately determine who was at fault for the accident and the extent of any injuries.

Policyholders who are involved in an accident that wasn’t their fault benefit from this, too. Using the driving data, they’ll be able to prove that they were driving safely, helping them to win their case.

Value-added services

Telematics technology allows insurers to provide clients with several perks. These value-added services are particularly attractive for drivers who are unable to get cheaper premiums despite having a maximum no claims discount – they provide a value which is otherwise unavailable.

Location tracking

The GPS receiver in telematics devices means that a policyholder’s car can be easily tracked down if it is lost or stolen.

Breakdown prevention

Driving data can identify signs of mechanical trouble. The driver can be notified and encouraged to check into a garage for maintenance work, reducing the chance of a breakdown.

Accident response

Telematics devices are designed to detect crashes. In the event of an accident, the insurer could call to check up on their client, even calling emergency services if they’re unable to do so themselves. The insurer could also arrange for the car to be towed to a garage for repairs or provide a replacement vehicle.

Rewards

Insurers can offer rewards that are linked to good driver behaviour, such as free coffee and cinema tickets.

The future of telematics insurance

Usage-based insurance policies are growing in popularity.

The global telematics insurance market was valued at $2.37 billion in 2020 and is projected to reach $13.78 billion by 2030.

Insurers have an opportunity to meet the increased demand while achieving a competitive advantage over their competitors.

However, implementing a telematics product requires a seamless relationship between the technology and the claims data. Due to the fragmentation of the sector, this isn’t always possible.

Insurers tend to outsource solutions to telematics service providers.

But telematics service providers guard their algorithms while insurers are reluctant to share their claims data.

This prevents the product from fulfilling its potential.

Howden Driving Data is uniquely placed to provide a holistic solution, combining over a decade of telematics with claims data.

Why Choose Driving Data?

Driving Data is the only large scale end-to-end telematics solution created from over a decade of in-house broking experience and billions of miles’ of live data.

Our comprehensive database of real claims is attached to actual driving and crash data, providing unique insight. This means our products are powered by behavioural science that have been tested with live customers.

What we have learned over the last decade puts us in a strong position to advise on best in class use of data to reduce loss ratio, obtain unique rates from capacity and provide return on the data investment.

Our enterprise platform is highly configurable and interoperable with any system or data source.