Insurance for Banks

Tailored insurance for the banking industry

Often, existing insurance products do not provide true protection for the fast-changing banking industry. At Howden we get to know the intricacies of your business, creating tailored insurance products to mitigate risks and build resilience.

How Howden can help Banks & their unique risks & exposures

We appreciate that financial institutions, and particularly banks, face a unique set of risk related challenges. Employee misconduct, tech and cyber-attacks, regulatory and trade body changes, differing working practices, and executive liabilities can leave banks exposed. This is why we have a team of specialists who are embedded in the issues relating to your sector and have a wealth of experience working with banks.

Often, existing insurance products do not provide true protection for the fast-changing banking industry. At Howden we get to know the intricacies of your business, creating tailored insurance products to mitigate risks and build resilience.

What sets us apart?

Specialism

We are specialists in your sector. This is essential as it allows us to differentiate your risks in a tightening and ever-changing market.

Market agility and execution

The team have an average of 18+ years’ experience in the market and are equipped to find solutions to risks where others may have not.

Data and analytics

Clients have access to data experts within the team. This gives us a birds-eye view of the market through combined client and sector data, which allows you to make informed purchase choices and access claims trends.

Legal, technical and claims support

We have a unique Legal, Technical and Claims team embedded within the proposition made up of senior insurance lawyers and experienced claims professionals, who support on insurance claims, policy wordings and legal and regulatory developments.

Service

When you become a Howden client you don’t just become another number. We see ourselves as extensions of your team and are highly available for service related discussions and to advise on all risk related matters.

Our global reach

Whilst the majority of our team is based in London, we have extensive reach around the world thanks to our global network. We have far-reaching experience internationally and can provide international compliance, regulatory and risk related guidance where necessary.

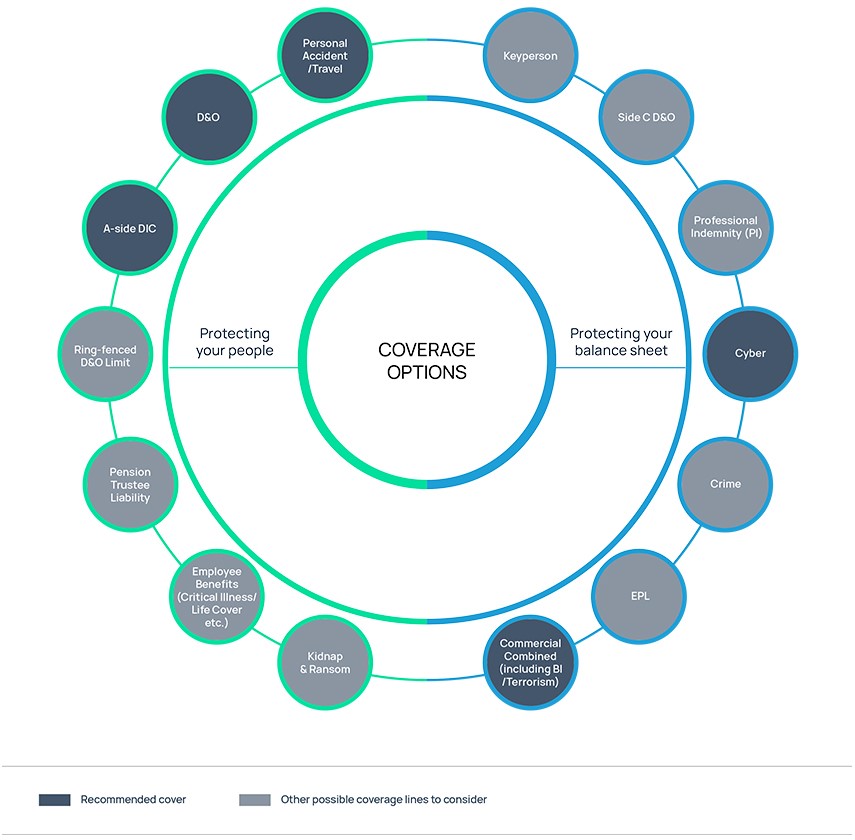

We consider your entire risk and insurance world and understand the need for it to work as one:

Are you a broker?

Click here for wholesale and international bank insurance options

Speak to the team today:

John

John Greene

John Greene

Divisional Director

John leads Howden’s Banks and Wealth Management teams and is responsible for the client service delivery. He has 20 years’ experience of insurance broking and client service with JLT, Marsh and HSBC and has worked with large and complex clients through significant corporate change and challenges.

John is known for his highly conscientious approach in delivering first rate service, strategic advice, and in really understanding his clients.

E: [email protected]

Lindsay

Lindsay Ratcliffe

Lindsay Ratcliffe

Divisional Director

Lindsay is a qualified lawyer and a Director within Howden’s Financial Lines Group. Lindsay works across a number of different sectors including Insurance Companies, Banks and Wealth. Lindsay helps to develop client propositions and ensure that Howden is constantly improving its offering across its specialisms.

Lindsay is known for delivering market leading, specialist advice to clients.

E: [email protected]