Buying or selling a subsidiary – what is the impact on PI and D&O Insurance?

Published

Read time

Liability insurance policies such as Professional Indemnity (also known as Civil Liability or Errors & Omissions) and Directors & Officers (“D&O”) insurance operate on a ‘claims made’ basis. If an aggrieved party makes a claim against the insured during the period of cover of a policy, it will be covered under that policy, regardless of when the alleged act that forms the basis of the claim took place.[1] However, the position becomes more nuanced when subsidiaries are bought or sold, or there is a corporate restructure. So how does coverage work in those circumstances, and what must policyholders consider?

Is a new subsidiary covered automatically?

There are two equally unhelpful answers to this question. A new subsidiary is covered (a) sometimes; and (b) for some things.

Whether a new subsidiary (and its directors) is covered at all focuses on language around acquisition or creation of new entities. Keep an eye out for a condition or extension entitled “Automatic Cover for New Subsidiaries” or similar. The relevant wording may also be contained in the definition of Subsidiary.

Generally, new subsidiaries (and their directors) will be covered automatically from the effective date of the acquisition, unless they fall foul of certain thresholds. Those thresholds are usually ones regarding revenue or claims history, or certain geographical limitations (often around the US). It is likely to be possible to cover a subsidiary that is not covered automatically with additional premium (and, occasionally, a modification of terms).

These restrictions on automatic cover arise because insurers view this as a change in risk. If a £10m revenue business becomes a £20m revenue business through acquisition, insurers consider they are entitled to underwrite that ’new’ risk and increase premium or apply additional terms. They are being asked to take on the risk of claims arising from a far greater number and higher overall value of professional transactions.

Crucially, however, an acquired subsidiary will only be covered in respect of acts that take place after the entity becomes a subsidiary. If the wrongful act took place before the acquisition there will be no cover, even if the claim is first made after the acquisition. Insurers provide insurance on the basis of the risk factors associated with the insured group. Anything that happened before an entity became part of that group is not part of their risk analysis. Company acquisition, therefore, becomes one of the exceptions to cover applying whenever an act took place: in the case of a purchased subsidiary, the claim must have been made in the policy period and the alleged wrongful act must have occurred after acquisition[2].

What if I sell a subsidiary?

The opposite analysis applies on the sale of a subsidiary. Unless policy terms are changed specifically, the group policy will continue to provide cover for claims that are made against a subsidiary, after that subsidiary has been sold. However that cover will only apply to acts of that entity before it was transferred and ceased to be a subsidiary. That continues to apply on renewal (i.e. a subsidiary sold on 1 March 2022 will still be covered for claims arising out of pre-1 March 2022 acts on the seller’s 2024 policy).

Past Acts of an Acquired Subsidiary

If the group policy covers only acts whilst the entity was a subsidiary, what about past acts? The previous section actually provides the answer to this question too. In these circumstances, it will be the sellers’ policy that continues to provide cover for those past acts (so long as there is no alteration of terms).

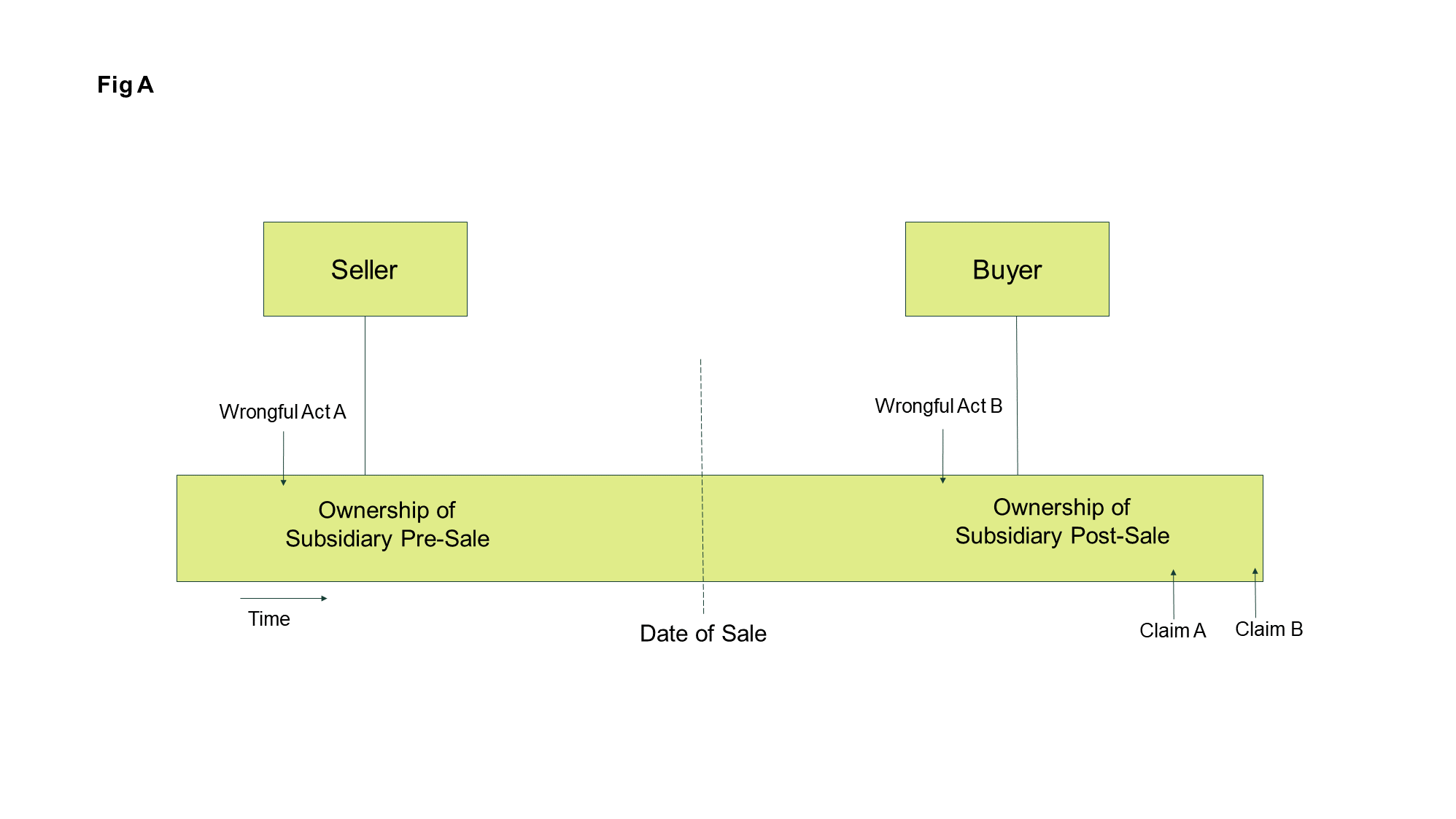

The diagram (Fig A) illustrates the correct policy for two claims. Claim A and Claim B are both made against the subsidiary during the time of the Buyer’s ownership of the subsidiary. However, the Wrongful Act underpinning Claim A occurred during the Seller’s ownership of the subsidiary. Therefore, Claim A will be covered under the Seller’s policy in place at the time Claim A is made (as these are claims made policies). Claim B is linked to a Wrongful Act in the Buyer’s ownership period, and so will be covered under the Buyer’s policy.

What if the Sale and Purchase Agreement passes on liability for past acts?

The agreement governing the terms of the sale of the entity may deal with liabilities for past acts, and may be factored into pricing. The agreement cannot change the correct defendant for any claims (which will still be the purchased subsidiary) but may alter where liability ultimately falls. Insurance for past acts, and the obligation to maintain cover, must be considered as part of the framework. As noted earlier, cover for past acts is provided under the standard terms of a seller’s policy, so long as those terms are not changed. If you are relying on the policy of a seller, it is imperative to ensure there is an enforceable obligation to maintain insurance.

Are there other insurance options?

Insurance will find a way to fit in with your liabilities and preferred way of managing risks. It is possible to purchase a standalone policy to cover only claims arising out of past acts for the subsidiary. Usually called “run-off cover”, these policies typically last for six years, matching the most common limitation periods for claims. Alternatively, it may be possible to provide cover for past acts in the group policy. There will need to be discussions with your insurers, a specific endorsement to override the usual position, and possibly the payment of additional premium.

The crucial point is ensuring that the insurance position matches your liabilities in relation to claims against the subsidiary, and that the subsidiary has appropriate cover for all eventualities. Discuss with your broker and the team dealing with the sale and purchase.

Sale of a whole Group

To add some further confusion, the discussion so far has assumed there is a corporate seller that will continue to buy insurance after the sale. If the whole group is sold, and there will be no ongoing insurance for the seller, the buyer will need an arrangement that covers both pre- and post-acquisition acts. That solution is often a run-off policy for the pre-acquisition acts.

Beware the Corporate Restructure

Policyholders may be blindsided by the insurance impact of a corporate restructure. As part of the restructure (which may happen due to a sale, IPO or for tax reasons, as examples) a new company may be incorporated, to become the topco of the group (“NewCo”). All other group companies are transferred into the ownership of NewCo, which also becomes the policyholder for insurance purposes.

You can see where this one is going. As all other companies are only subsidiaries of NewCo from the date of transfer, they lose all cover for past acts. Plainly, the analysis of the insurer not having taken into account the risks of a new subsidiary does not apply here, and the exclusion of cover is doubtless accidental, but it is a very real risk without careful wording changes to the standard position.

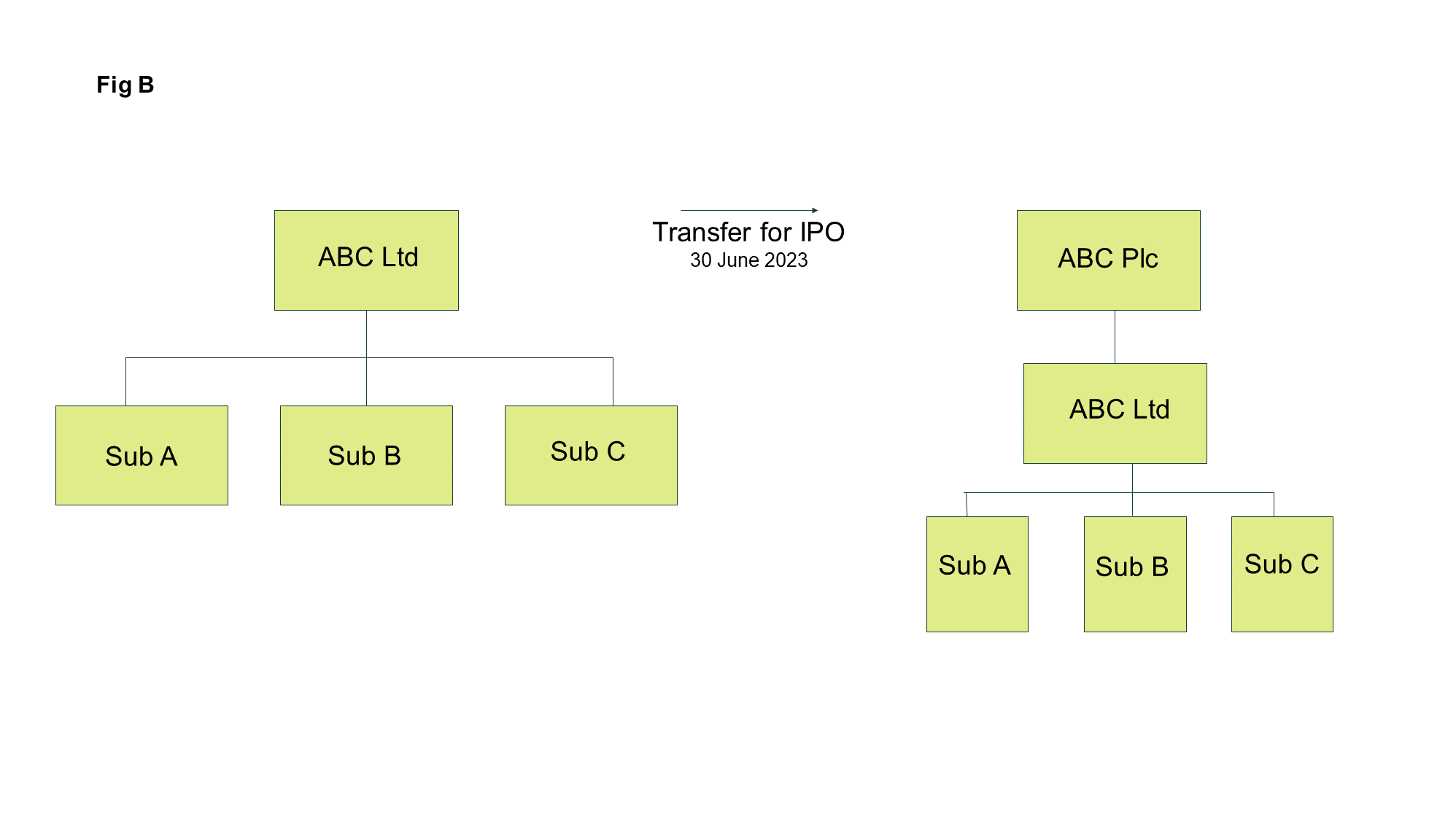

The diagram (Fig B) demonstrates what happens when ABC Ltd is transferred to ABC plc for the purposes on an IPO. ABC Ltd and its subsidiaries come under the control of ABC plc only from 30 June 2023, and so, under the ABC plc policy, lose cover for all wrongful acts prior to that date unless the policy is amended.

How does this apply to directors?

Whilst a little more complex, in that a D&O policy has the additional layer of coverage for individuals, the position is ultimately the same. The directors of a sold subsidiary will have cover for pre-sale acts under the policy of their pre-sale owner, and vice versa (subject, as always, to changes in those standard policy terms).

Keeping Insurance in Mind

Insurance policies are something many people turn to once every 12 months for renewal, and then hope they can be locked away and forgotten about until the same time next year. Subsidiary acquisition and corporate restructures are events that mean that insureds will need to unlock the policy drawer, and consider and discuss the implications with the deal team. As an insurance broker, we deal with queries on these subjects on a regular basis and can help guide you through what is (admittedly) a complex insurance maze to ensure you are fully protected.

- Subject to exceptions, some of which we discuss below.

- There are always exceptions to this general position, and it will depend on the policy wording. For example, the solicitors’ rules on successor practices mean that claims for pre-acquisition acts will fall to the policy of the acquiring practice in certain circumstances.

Meet the team

Sam

Sam Vardy

Carey

Carey Lynn

Neil

Neil Warlow

David

David Jones

Contacts us

Sam Vardy, Divisional Director

T: +44 (0)7719 928600 | E: [email protected]

Carey Lynn, Managing Director

T: +44 (0)7923 229882 | E: [email protected]

Neil Warlow, Divisional Director

T: +44 (0)7923 208441 | E: [email protected]

David Jones, Associate Director

T: +44 7521 776930 | E: [email protected]