Insurance for international banks

Global Reach, Local Touch

Often, existing insurance products do not provide true protection for the fast-changing banking industry. Many place restrictions on coverage, which render elements of the policy ineffective. To avoid these problems, we create market-leading products that redefine what is possible.

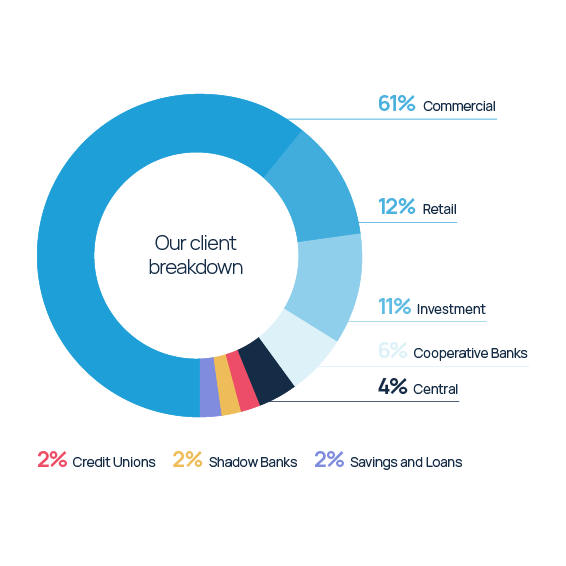

Our client breakdown

For us the relationship is personal, not transactional. Our policies minimise exposure to loss while at the same time eradicating superfluous cover - bringing you an optimised balance of protection and cost.

Over 160 banks and 2,500 asset and fund managers worldwide choose Howden

$104m+ total claims paid in the last 3 years

Specialism

We are specialists in your sector. This is essential as it allows us to differentiate your risks in a tightening and ever-changing market.

Market agility and execution

The team have an average of 18+ years’ experience in the market and are equipped to find solutions to risks where others may have not.

Data and analytics

Clients have access to data experts within the team. This gives us a birds-eye view of the market through combined client and sector data, which allows you to make informed purchase choices and access claims trends.

Legal, technical and claims support

We have a unique Legal, Technical and Claims team embedded within the proposition made up of senior insurance lawyers and experienced claims professionals, who support on insurance claims, policy wordings and legal and regulatory developments.

Service

When you become a Howden client you don’t just become another number. We see ourselves as extensions of your team and are highly available for service related discussions and to advise on all risk related matters.

Our global reach

Whilst the majority of our team is based in London, we have extensive reach around the world thanks to our global network. We have far-reaching experience internationally and can provide international compliance, regulatory and risk related guidance where necessary.

The full spectrum of solutions

Employee dishonesty represents over 80% of our clients' losses, either directly or as a vector for criminals. Our policies remove any need to explain motives.

Loss sustained by the bank, or loss for which they are legally liable, including fees and expenses, resulting from dishonest, fraudulent, criminal or malicious access by any person or entity to any computer system used by or relied upon by the institution.

Loss resulting from third party claims made against the bank for Civil Liability provided such claims arise out of the provision by the bank of Financial Services,

Protection against the costs of defending a court case, regulatory investigation, or the settlement of a claim against a director or officer. Failure to purchase proper protection can be costly for businesses and put the personal assets of directors at risk.

Howden’s Climate Risk and Resilience practices addresses the risks associated with a changing climate and aid the transition towards net-zero carbon emissions. The team focuses on risk transfer products that help to accelerate and de-risk the move towards a low-carbon economy, and to mitigate the results of climate change.

We offer three different approaches to transferring risk resulting from a hurricane or other extreme weather event. We offer these alternatives so that each financial institution may decide for itself which of these routes it considers to be most beneficial. These are; bespoke protection, group protection, customer protection.

Credit insurance is an unfunded risk transfer product, substituting counterparty risk for insurer risk. The insurer(s) indemnifies the insured for any net loss following non-payment by a borrower under a specified obligation.

Speak to the team today:

Blair

Blair Buchanan

Blair Buchanan

Head of International Financial Institutions

Blair joined Howden in 2008 and has focused solely on providing Comprehensive Crime, Cyber Crime and Liability solutions for financial institutions and multinationals around the world. Blair has successfully negotiated the programs of more than 120 banks worldwide and has been a market benchmark in terms of product innovation, development and placement.

Vlada

Vlada Barratt

Vlada Barratt

Associate Director

Vlada, has over 17 years’ experience in handling Directors & Officers and Financial Institutions insurance and reinsurance risks, having prior experience in International Treaty Reinsurance. With exposure to clients and insurance markets across multiple jurisdictions, her broad technical knowledge and strong negotiation abilities are fundamental qualities which ensure that the very best outcomes are delivered.